Empire builders, you know that you’re already dedicated to achieving success with your dropshipping business. But what comes next after the money rolls in? Yes, it’s fantastic to make ten grand a month, but what’s much better is making ten grand a month for years and years on end. It’s the difference between having money with dropshipping and having wealth with dropshipping.

One is a temporary state, while the other is a solid financial foundation that lasts for the long term and can even become generational wealth. For many of you, achieving this kind of enduring wealth from your dropshipping business is the goal. If it isn’t already, then it absolutely should be. Let’s talk about how it’s possible to use dropshipping as the stepping stone to creating long-term wealth for you and your family.

Build Wealth With Dropshipping by Thinking Long-Term

I’m always preaching about the importance of thinking about your business in terms of the broader picture, including years down the line. If you want to build wealth, and I know you do, then having that long-term perspective is essential. For many of you, dropshipping is going to be your very first entry point into making money online. But what you do after you start earning from dropshipping is incredibly important.

This is the advice I wish someone had given me 10 to 12 years ago when I was getting started with my online businesses — before I ever made my first dollar.

What I’ve learned over the years about building wealth with dropshipping or any other business is that it’s not how much you make. It’s how much you actually keep within your businesses that matters. That means using your profits to reinvest and create a more solid foundation.

A lot of people that start out in dropshipping are not setting up their business properly, and they don’t know what to do with the money they make. They get excited and rack up a ton of expenses. Buying nice clothes and fancy things feels good in the moment, but it definitely doesn’t create wealth. Before spending on luxuries, think about the long term. Only spend money that you really don’t need and won’t even bat an eye at. If making that expense is going to affect the decisions you make in your business, such as not being able to invest in something that can help you grow, then just forget about it.

Getting Your Money Right

Making sure your business is structured properly is one of the most significant things that’s going to set you apart from everybody else. This is one of those nuggets I really wish I could have told myself 12 years ago because I would have saved millions of dollars.

When I got started, I made all the expenses for my business with my personal credit and debit cards. Naturally, the profits that came in went straight to my personal bank account. I had no idea that I needed to be separating the spheres of my business and my personal finances. Most of you are probably making these same mistakes I made and, trust me: this is killing you. If you don’t have the money from your business flowing properly, you are wasting so much money and paying so much extra in taxes that it’s not even funny.

You won’t build any wealth until you get your money right.

How to Think About Taxes and Finances

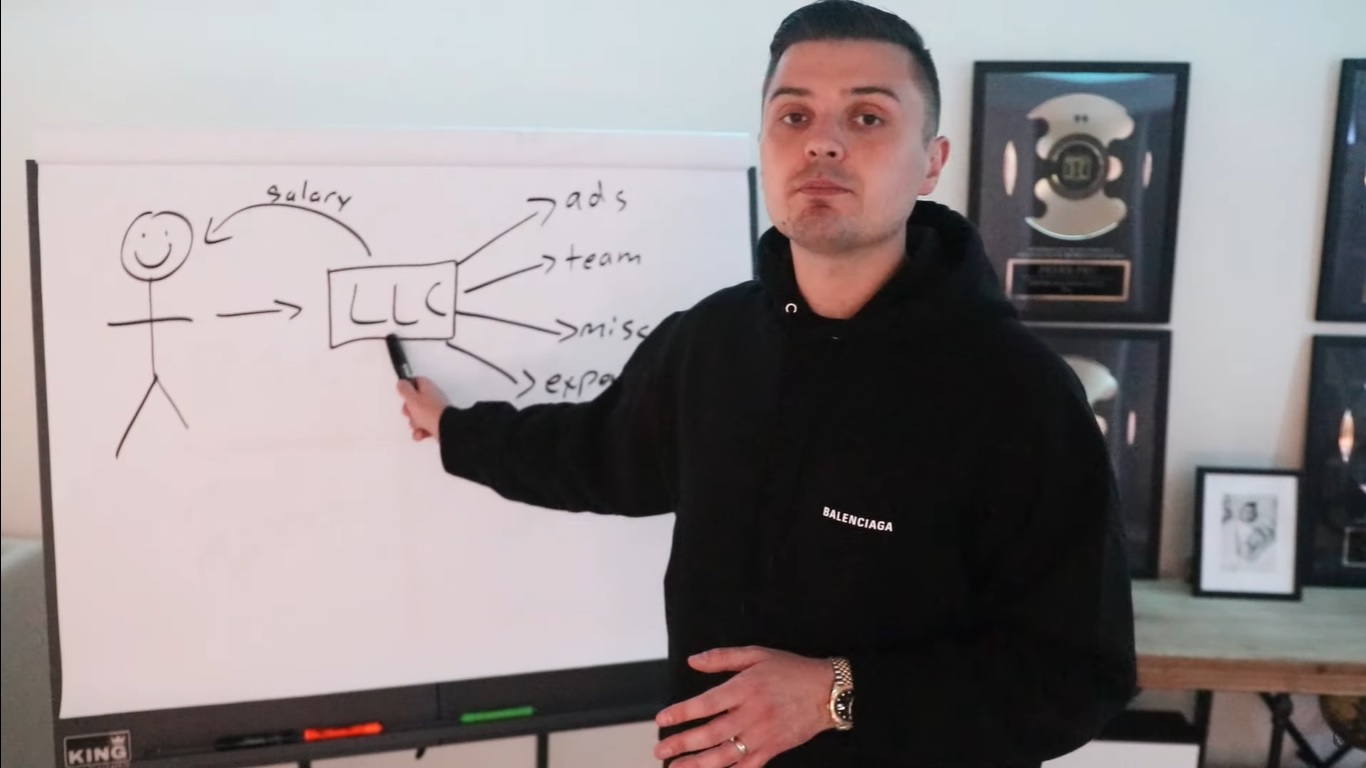

The problem with running your business this way is you’ll get hit with a massive tax bill at the end of the year. You’re taking a salary from your business and then paying for your ads, your team members, your business trips, miscellaneous expenses, etc., from your own personal accounts. Every dollar you pay yourself as salary comes with income tax. So you’re essentially getting double-taxed for all business expenses. You’re paying the income tax and then also paying the actual taxes on the product.

Trust me, that’s not how you build wealth. You need to get your money right by creating something that legally separates you from your business. Something that makes it so that every business expense becomes a tax write-off instead of a tax liability. That “something” is called an LLC.

A Quick Overview of Setting up LLCs

There are many types of business structures out there, including S-Corp and C-Corp. Typically, you want to set up your dropshipping business as an S-Corp. But it depends on your unique situation, and I am NOT giving legal advice. If you want professional guidance for how to get your money right, I definitely recommend scheduling a call with the team at PCS. They worked with me to help me set up my businesses and opened my eyes to strategies that I never knew about. They’re great people, and they’re helping me save millions of dollars, so that’s why I can enthusiastically recommend them to anyone. If you’re still using your personal accounts to do business, it’s time for a new strategy.

Once you have an LLC, many doors will open up for you. That’s why it’s a crucial step in the direction of building wealth. All your business expenses will now be made by the legal entity occupied by your business. You can think of it as a person that’s separate from you because, legally speaking, that’s what your LLC is. Now your business can pay for courses, pay your marketing expenses, and pay for services. It’s all completely separate from the personal income in your salary.

There’s a huge variety of things that can be considered a business expense, which means there are massive tax benefits just for being a business owner. And this is only the beginning.

Build Your Empire and Long-Term Wealth With Dropshipping

I’m going to let you in on a little secret. You will never get wealthy by paying yourself more from your business. Wealth comes from growing your businesses and creating more value. It’s as simple as that. You need to focus on building an empire and investing back into it as much as you can. Jeff Bezos, for example, doesn’t pay himself a huge salary even though he’s the richest man in the world. He doesn’t need to because he controls Amazon and puts his focus on growing Amazon.

When you own things personally, that just sets you for liability. Try to own as little as possible. Instead, create an empire and control it all. If you want to build wealth with dropshipping, you can’t just have one business, either. Having only one business means you’re not optimizing what you have well enough or profitably enough.

The Value of Multiple LLCs

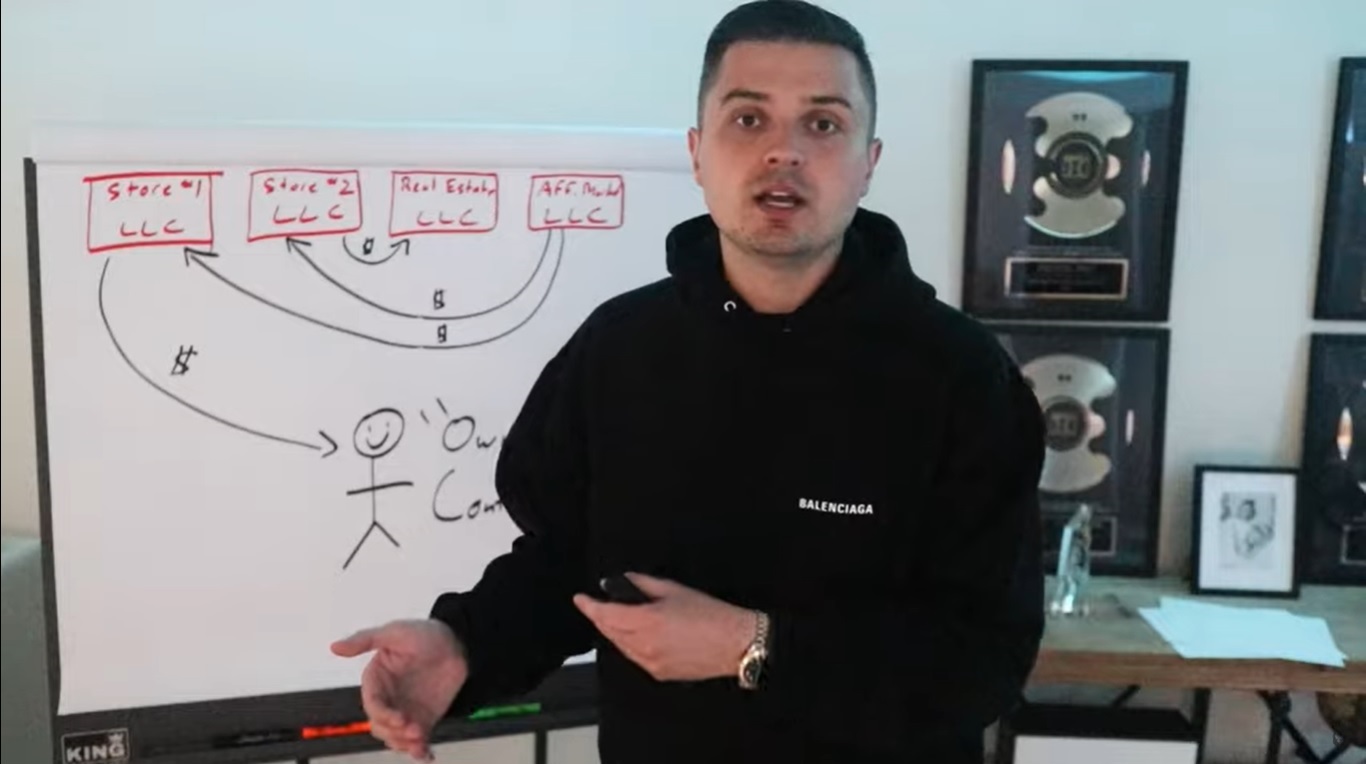

If you set up your dropshipping business as an LLC and you’re making money, that’s absolutely fantastic. But let’s say you have another business idea, and you start another dropshipping store. That’s even better. Now you open up a second LLC, and the new business can be completely separate from the first one. Why do you want to do that? Because if your original LLC gets sued, you’re legally protected. They can’t come after you personally, and they can’t go after any other LLCs you have. Remember, each LLC is its own entity.

This is where it starts getting interesting and where it becomes possible to build long-term wealth. Because remember, you don’t want to pay a lot of income tax. Don’t pay yourself a salary that’s the most you can possibly afford to pay yourself. Instead, nurture your empire at every opportunity. For example, the way that my business is structured is that I have multiple LLCs. I pay myself a salary from only one of them.

In the case of another LLC, I’m able to take those profits and reinvest them back into wealth-building projects like real estate. In legal terms, this investment would be considered a loan from one company to another. That means I create a third LLC that owns rental property, generates a cash flow, and pays back my other LLC for the initial investment.

I also have an LLC dedicated to affiliate marketing, which is a fantastic side project for generating extra money. Any dropshipper will benefit from going to Clickbank, finding some relevant niche products that are for sale there, and then promoting them to your customers with affiliate links.

These are just a few examples of what’s possible when you want to create wealth from your dropshipping income.

The Impact of Multiple LLCs

Doing business this way means that you can minimize income taxes, maximize tax deductions for business expenses, and stay focused on reinvesting in your empire. Beyond my modest salary, I don’t want that money for myself. I want it to be circulating amongst my businesses, helping me to grow and creating a solid foundation of wealth.

Why Delayed Gratification Is Crucial for Wealth With Dropshipping

Personally, my lifestyle doesn’t get crazier with the more money I have. But that doesn’t mean I don’t reward myself for milestones. It’s all about finding a balance and staying focused on your broader goals. Be honest with yourself about what you can really afford and where your priorities should be. For example, I like nice watches. Maybe for you, it’s something else. If you can utilize these extravagant purchases to motivate yourself to get to the next level, and the next level, then that’s great.

But make your consumption as mindful as possible. That’s how you create wealth with dropshipping: by delaying a little bit of gratification in service of your long-term goals. You should definitely enjoy your success but never at the expense of growing your businesses. Get your money right and get yourself set up. Make sure that when the moment comes that you want to spend ten grand on something you really enjoy, it’s because you can genuinely afford it — in short, because you’ve earned it.

If you want to learn much more about building wealth with dropshipping and a high performing ecommerce business, you’ve come to the right place. To get practical advice on creating a full-time income online, reserve your free seat at our sales funnel masterclass. You can also subscribe to our YouTube channel for regular tips and insights.