When you start a business, you can never be too careful about protecting yourself and your personal assets from legal liability. If you run a dropshipping business, in particular, you should make sure you are on the safe side. While there are various ways to protect yourself from liability, the most popular and highly recommended is registering your dropshipping business as an LLC — a limited liability company.

The first and most attractive benefit of registering your dropshipping business as an LLC is the tax benefits you could enjoy. Many new entrepreneurs trying dropshipping for the first time eventually come to this realization.

Many entrepreneurs often fail to realize how much money they can save by putting expenses on their business rather than paying themselves first, then paying for the expense. As a result, they at times lose as much as 50 percent of the money with such a simple mistake.

This post will guide you on the benefits of setting up an LLC and enjoy all the benefits it brings.

Keeping Most of the Money You Make

Everyone starts a business to make as much money as they can — and keep most of it at the end of the day. However, if you are new to dropshipping or just getting started in the business, it is not uncommon to feel jittery and have ‘what-ifs’ regarding running the business.

If you can eliminate most of the concerns of running a business by simply registering it, then your life as an entrepreneur will be much easier and your profits better protected. By taking steps to educate yourself on starting and running a business, you have already shown intent to start a business.

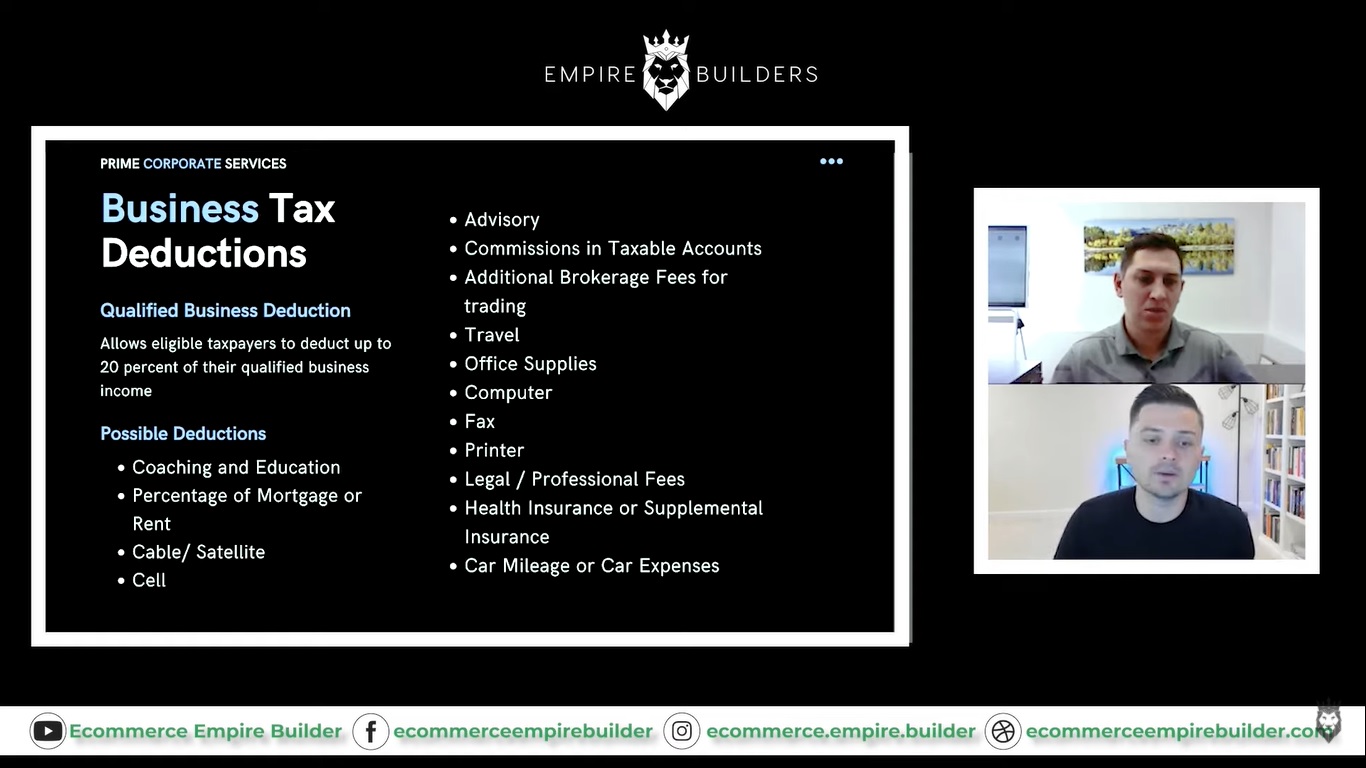

With the proper business structure, you could access as many as 250 different tax deductions and ultimately keep thousands of dollars that you would otherwise pay in taxes as profit or re-invest into the business.

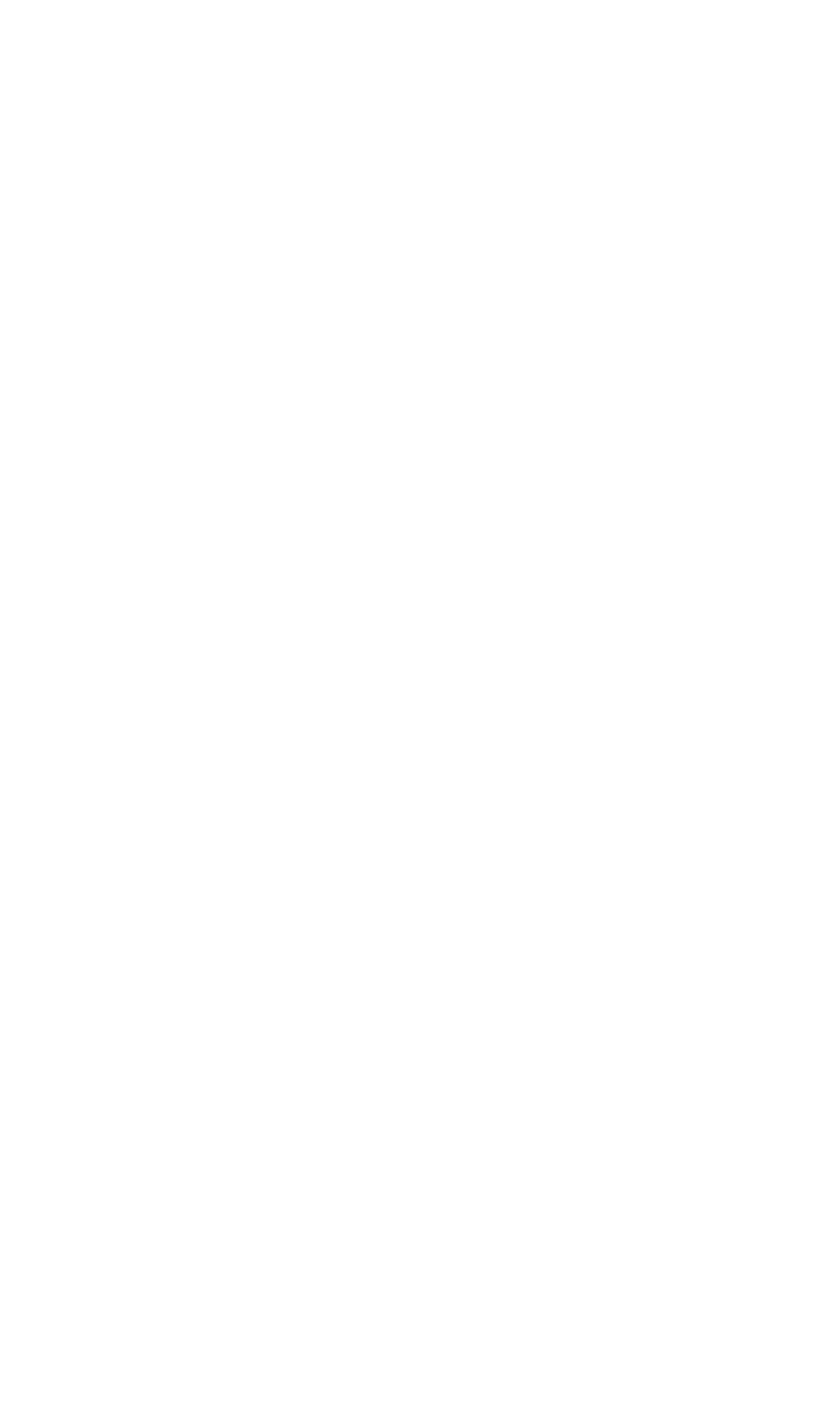

By investing the time and money to start a business, you could qualify for many possible deductions, including:

- Advisory expenses

- Cable, satellite, and cell charges

- Coaching and education

- A percentage of your mortgage or rent

- Additional brokerage fees for trading

- Computer, printer, and office supplies

- Health or supplemental insurance

- Travel, car mileage, and motor vehicle expenses

- COVID-19 deductions

Clever categorization of expenses reported to the IRS can help the business pay taxes at a lower tax bracket and keep more income. The key consideration is when deciding whether to record an expense as an ordinary or a necessary business expense.

The Pass-Through Taxation Benefits of Registering Your Dropshipping Business as an LLC

When you form an LLC or a corporation, the IRS will consider you a legal business entity, depending on your situation. These types of businesses are considered ‘flow-through’ or ‘pass-through’ entities. Therefore, as long as you have a taxable income, recording it as a business income offers great benefits regardless of the source.

Registering your business as an LLC or corporation comes with attractive business credit advantages. You can enjoy business credit on the income the IRS considers ‘flowing through’ the business.

Pass-through or flow-through is a tax function that allows you to file business taxes with personal taxes. In the process, you can use tax deductions against all income, including any W-2 incomes, to further lower your Total Taxable Income across the board.

As fancy as it sounds, ‘flow-through’ and ‘pass-through’ income are just fancy terms for money that comes into and flows out of the business. It is noteworthy that any losses the company records will also reflect on your tax returns, significantly lowering your taxable income.

It may seem complicated, but if you register an LLC and see the savings you can make by taking advantage of tax deductions, you will understand better and appreciate how it works in under a year.

Personal Asset Protection

LLC is an acronym for Limited Liability Company. The term refers to a business entity in which the owner is not personally liable for the debts and liabilities of the company. Simply put, the two most important benefits of registering a limited liability company are:

- You will not be personally responsible for the business debt.

- Your personal finances and assets will be safe from the liabilities of the business.

Separating business and personal assets and finances is a sure way to get peace of mind while running a business in the modern market. When you are certain your assets and finances are protected, you can focus on the business. You can stop worrying about potential lawsuits should the business make losses.

Some of the potential lawsuits from which you can protect yourself by registering your dropshipping business as an LLC include:

- Breach of contract

- Premises liability

- Employee and customer discrimination claims

- Harassment

- Faulty product or service lawsuits

- Intellectual property rights

- Misleading claims

- Auto accidents

Many people avoid starting an eCommerce business because they do not want to take the chance of getting sued. Americans file 40 million lawsuits every year — that is about 76 new lawsuits every minute.

The sued parties often spend a lot of time and effort defending themselves. If they lose, it costs them money and even personal assets such as a house or a car. Registering your dropshipping business as an LLC eliminates the need for you to worry about getting sued in a personal capacity for business liability. Instead, you can focus on running the business.

Business Credit Formation

Many people mistakenly assume that they need to have large businesses to access business credit or corporate funding. Most businesses start with personal credit or funds. But personal credit must remain personal, and the business must develop its own credit for long-term growth.

To give your business room to grow, you must build separate credit for your business. The business will pay for itself, and from there, it will pay you. Registering your dropshipping business as an LLC offers many benefits, including:

- Separation of personal from business funds and credit

- Access to more funding options available to corporations

- Lower interest rates on loans

- Higher limits on loans and credit cards

Final Thoughts About Registering Your Dropshipping Business as an LLC

This post is just a summary of the core benefits of registering your dropshipping business as a limited liability company. Whether you already have a business or are considering one, you cannot afford to overlook these benefits and many others.

Do you want to learn more about how to start or run a successful eCommerce business in today’s competitive market? Reserve a seat at our exclusive webinar to learn little-known tips to build an ultra-profitable dropshipping business today. You can also subscribe to my YouTube channel for more details about succeeding in eCommerce and registering your dropshipping business as an LLC.