Empire builders, you already know that there is a lot to learn when starting your own ecommerce business. While there are many important details you need to learn to create a successful dropshipping business, the most essential element to understand is the importance of an LLC for your ecommerce business.

A properly set up LLC will save your business so much money — money that can be reinvested into the business. I have an LLC set up for my business and have already been able to save millions of dollars through the taxation benefits it provides. Read on to learn more about LLCs and how you can utilize one to save money in your own ecommerce dropshipping business today.

What Is an LLC?

An LLC, or limited liability company, is a form of a private limited company in the United States. It is essentially a business structure that enables the owner of a business to not be personally liable for the company’s debts or liabilities. This is a wonderful thing. An LLC doesn’t just allow business access to a number of money-saving tax codes. It also creates a protective barrier between you and the customers of your ecommerce business.

There are also a number of different types of LLCs. They range from S Corp to C Corp to Partnership to Sole Proprietorship. There are a ton of free resources available on the internet for you to learn more about these different types of LLCs. You can also talk to qualified professionals like Prime Corporate Services to learn more about LLCs and business tax planning. These are the guys that helped me set up my LLC. They also helped teach me about the best tax planning options for my business.

You will definitely want to reach out to them when you are starting the process of creating your own LLC. Their guidance helped me understand how I can use the tax codes to benefit my ecommerce endeavors.

An LLC for Your Ecommerce Business Will Create New Opportunities

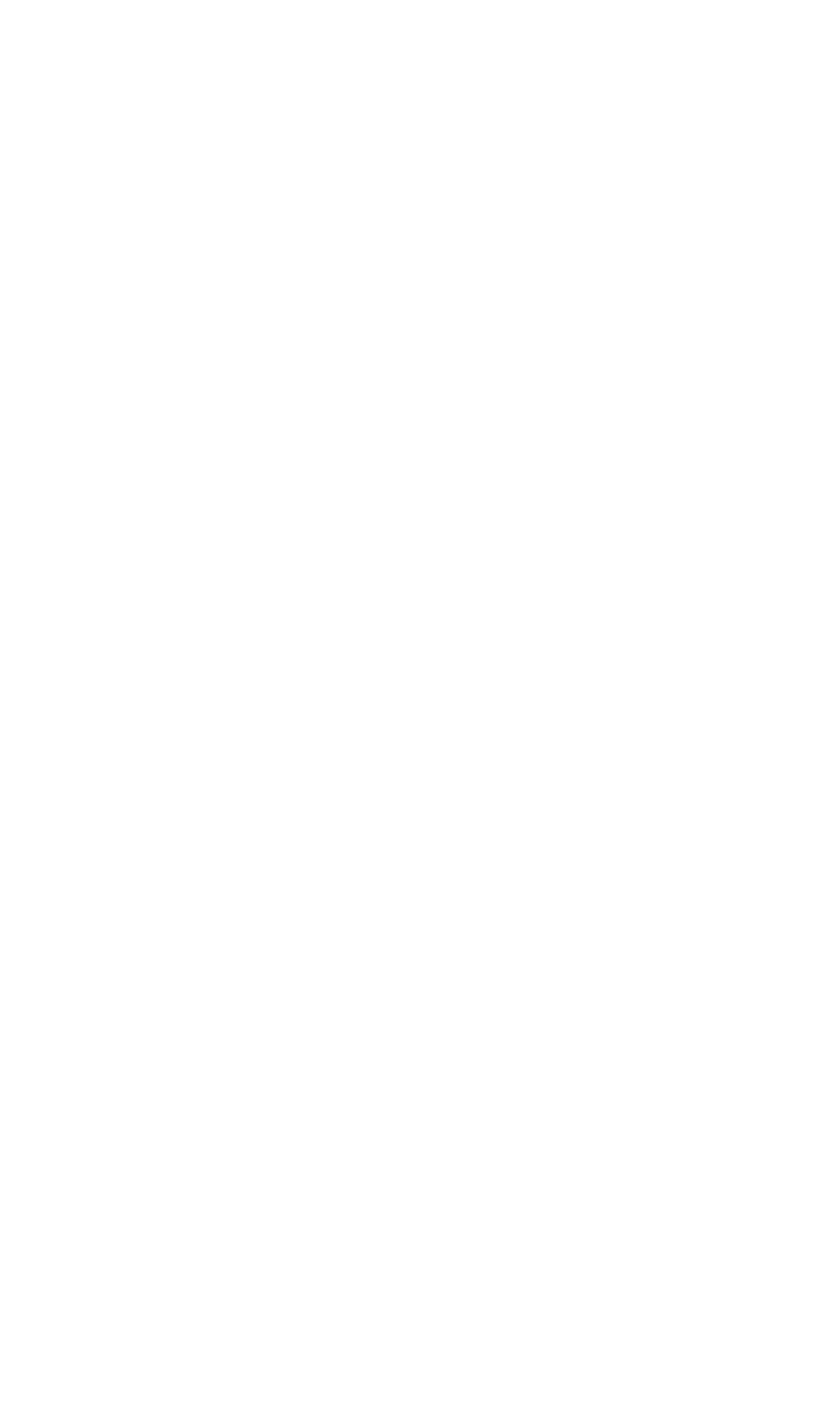

Now you know what an LLC is, but you’re still wondering if you really need one for your ecommerce business. Let me tell you — an LLC has the power to completely transform all of your ecommerce endeavors for the better. An LLC for your ecommerce business will give it a multitude of benefits and opportunities that you simply won’t be able to access without the creation of an LLC. Before I filed for my own LLC, I was wasting so much money in taxes each year. This was money that I could have been using to invest more in my business. If you’re making this same mistake right now, you have to take the actions necessary to create your own LLC today.

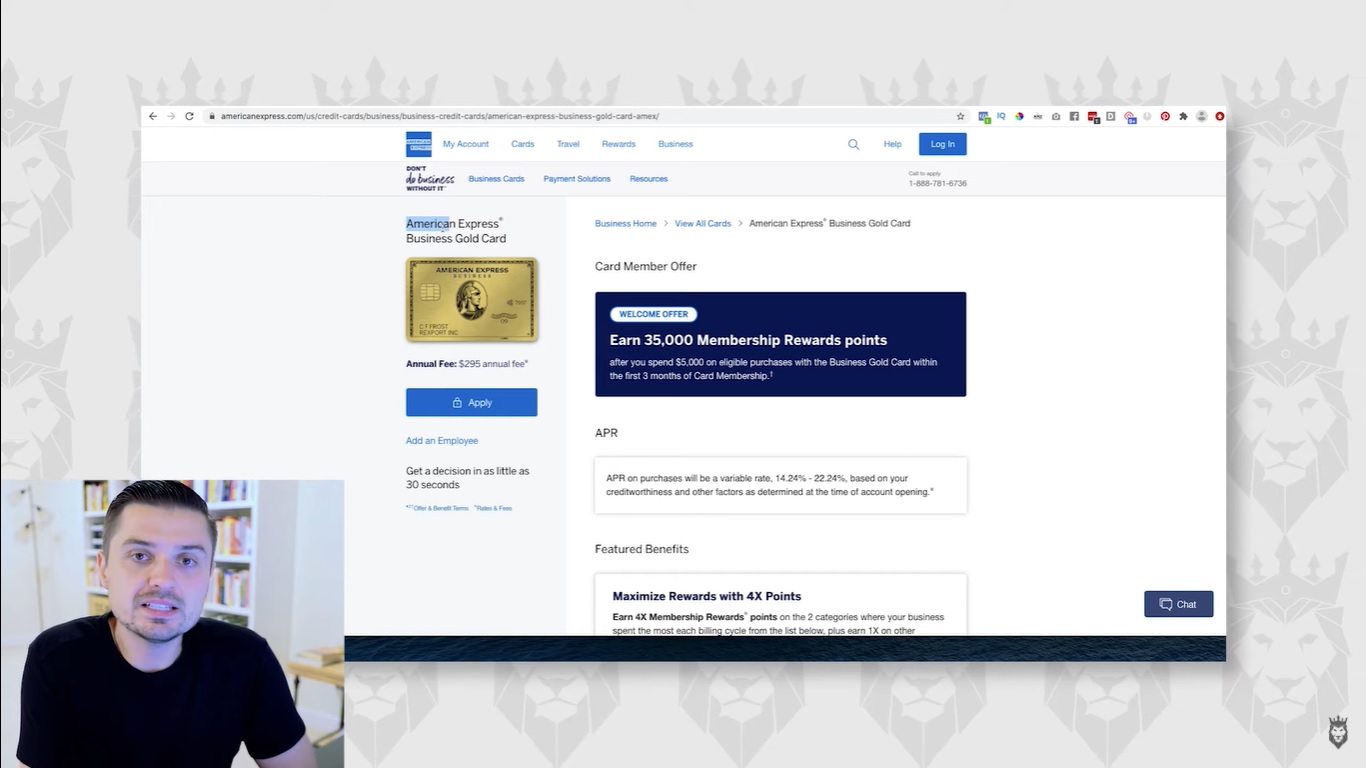

Once you have your own LLC for your ecommerce business, your company will be given an EIN. This number is similar to a social security number given to individuals. With your business’s assigned EIN, you can set up separate bank accounts and credit cards that don’t link to your personal accounts.

This is a huge protection that you need to take advantage of.

If you were to sell a product from your business without having an LLC in place and a customer got sick or hurt from it, the customer can come after you directly. With an LLC, they sue your business instead of you on an individual level. This ensures that your personal assets and livelihood will remain protected throughout all of your business endeavors. I’m not telling you any of this to scare you, but rather to help you transform your business, protect your livelihood, and help you see the multitude of opportunities that an LLC can provide to your ecommerce business.

Everyone Should Have a Business

My final push to get you the benefits of an LLC for your ecommerce business is to highlight the many tax benefits you will access. The United States tax codes were essentially created for business owners. The idea is that business owners help to create jobs and employ citizens. This process stimulates the U.S. economy.

Therefore, to help business owners boost the economy, the government has created a number of tax codes to benefit business owners. For this reason alone, I believe everyone should have some type of business. Even if you are happily employed, I encourage you to start some type of side business. Business owners have over 250 kinds of expenses that they can write-off. Employees simply do not get these benefits because they have no expenses for their job. The only way to tap into these benefits is by creating your own business.

Some of the top write-offs I utilize in my ecommerce business are business meals, travel expenses, computers, phone, internet, consultants, courses, and training. I even rent out a room in my house to my business as I use it for my office space. Essentially, nearly anything that is bought for the business can be written off as an expense. To get a clearer picture of what you can write-off for your business, check out the IRS’s resources for small businesses. Also, talk to tax professionals like Prime Corporate Services. At the end of the day, these tax codes are here to help business owners. You can either use them to your advantage or let them work against you. The choice will always be yours.

Consult With the Pros

I hope you will be able to take the information presented and implement it into your own ecommerce business. If you feel like you need a little more guidance in setting up your own profitable ecommerce business, then feel free to reach out to us today. At Ecommerce Empire Builders, we can help you build, launch, and scale your own profitable dropshipping business. To get the ball rolling, sign up for access to our exclusive free webinar today. Be sure to check our YouTube channel for even more free resources and insights into dropshipping. Remember, your empire starts now!