One of the most important aspects of a dropshipping business is payment processing. However, it can be difficult to choose the right payment processor for your business — whether you’re a US or non-US resident. You may also experience problems with processors such as PayPal and Stripe, which may lead you to turn away from those and seek alternatives. Check out these four dropshipping payment processors and find the right one for your business.

How Stripe Changed eCommerce

Before the introduction of Stripe, which made it easy for ecommerce business owners to set up payment and get approval, there were many steps involved in setting up payment processing. Some of these steps included:

- Setting up merchant accounts

- Handling payment gateways

- Organizing and maintaining sufficient documentation

All of these steps made it a daunting task to set up payment processing. With the advent of Stripe, business owners (including dropshippers) could easily accept online payments via credit card and other methods.

However, with more simplicity comes more responsibility: Stripe can easily shut users down for violations or customer mistrust. Stripe, like other payment processing platforms, has the best interest of the customer in mind, which can lead to shutting you down if your dispute rate or chargeback rate is too high.

If you’re just starting out in dropshipping and need a reliable dropshipping payment processor that can give you the best results, you may want to use Stripe. But there are also other options, depending on your needs and preferences. The following are our picks for the top four dropshipping payment processors available for both national and international users.

1. Stripe

Although certain caveats come with using Stripe, we still recommend this for both new and veteran users. The main reason we recommend Stripe is because it takes no time to get approved, and you can begin taking payments immediately after setup.

As your business begins to grow, managing Stripe could become more complicated. For instance, Stripe may begin holding your funds if your dispute rate exceeds one percent. Eventually, this could lead to shutting you down.

While you may risk having funds withheld and your account closed if you experience too many issues, Stripe is still one of the most reliable payment processors out there. You just need a solid plan so you can manage disputes and chargebacks.

Even if you are in another country where Stripe isn’t supported, you may still be able to set up an account.

2. PayPal

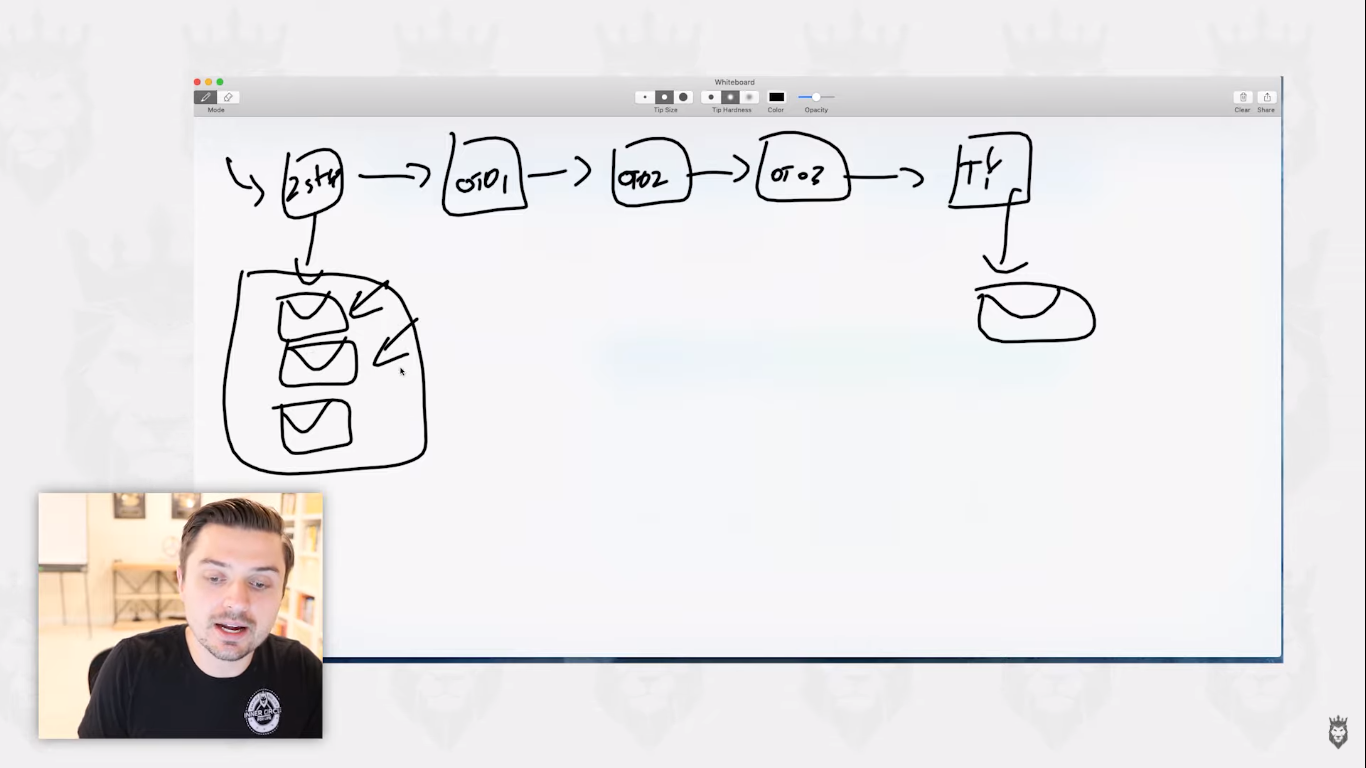

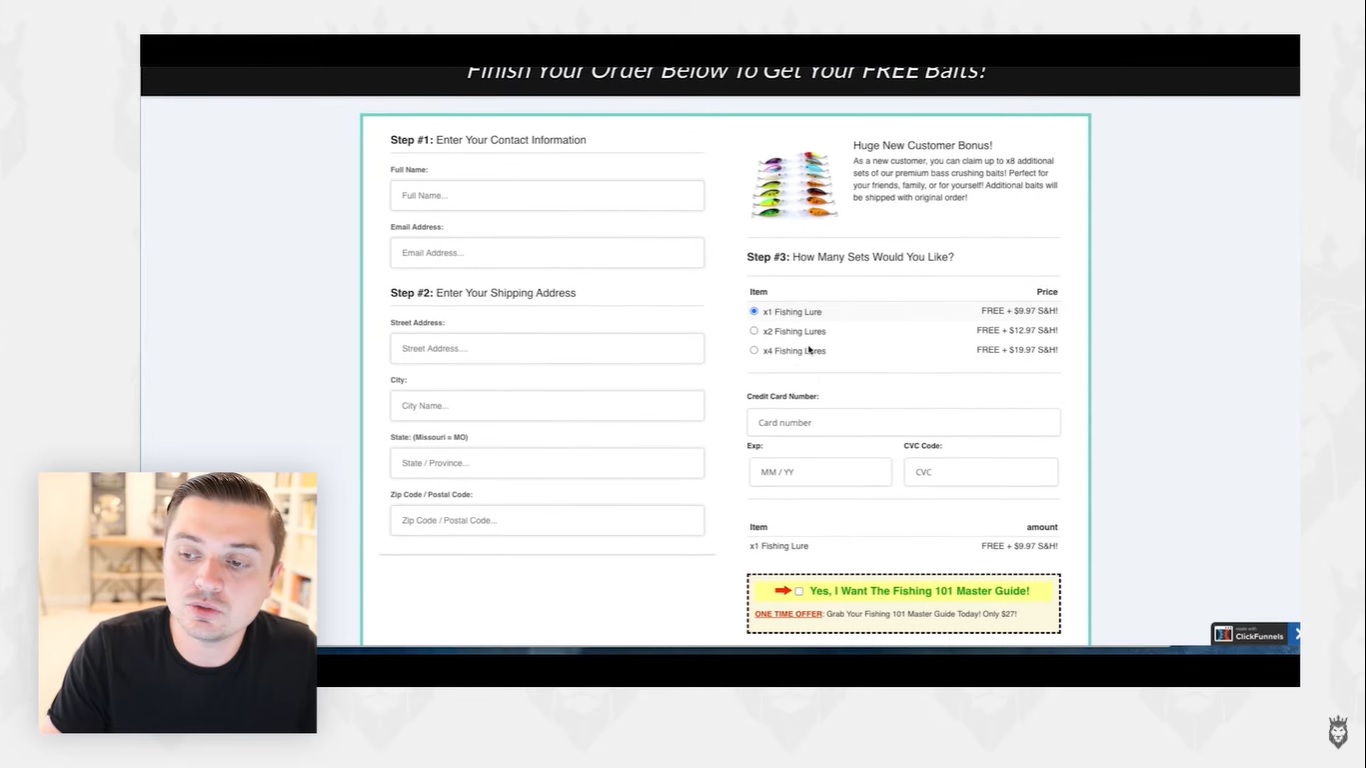

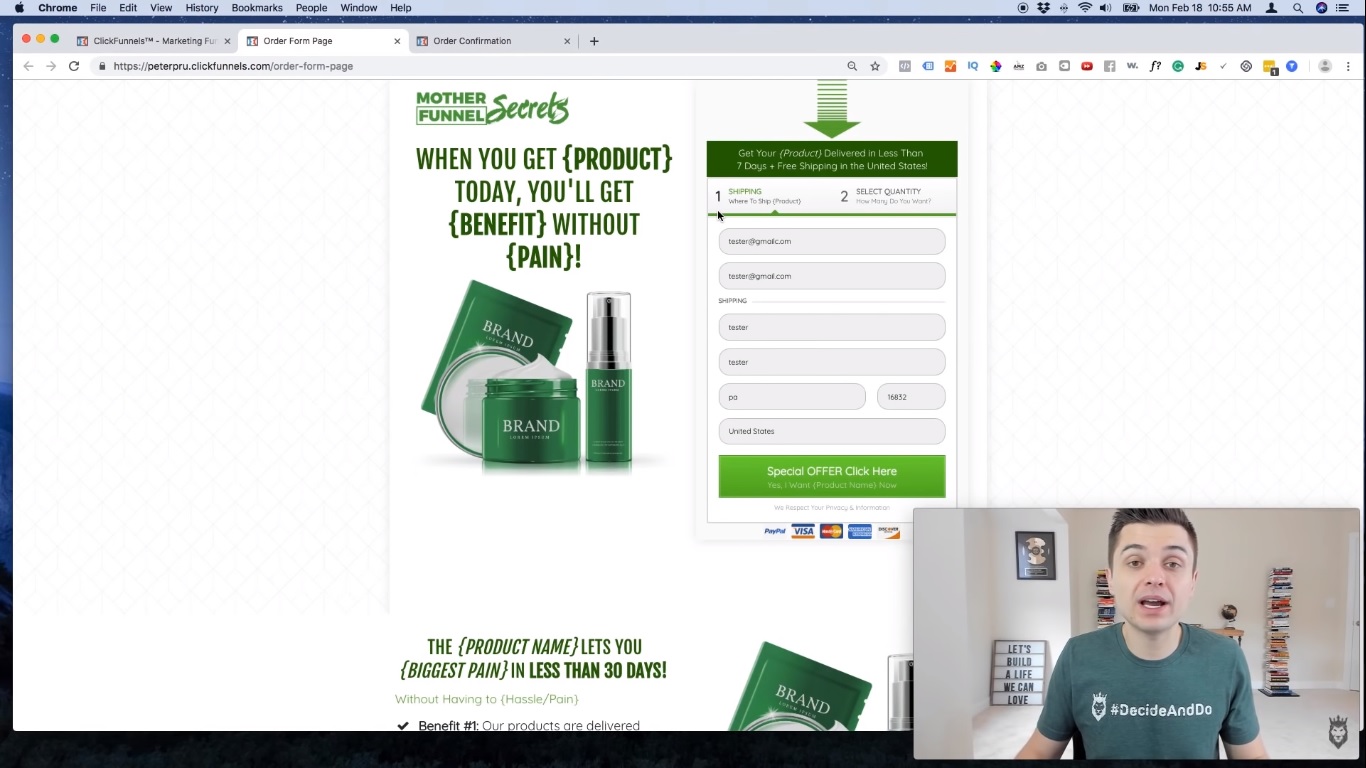

We also still suggest you use PayPal, simply because of the boost in conversions that it can give you. This is because while you can still get conversions if you set up Stripe and a sales funnel, you can gain more credibility if you take the time to set up a PayPal account and include that badge in your sales funnel.

A lot of people also prefer to pay with PayPal because of its dependability and security. It also tends to make it easy for customers to make a purchase. You can even integrate Clickfunnels and Paypal, which I go over in this step-by-step video.

On the other hand, many people are hesitant to use PayPal because of certain issues that can happen. After all, PayPal has been known to withhold funds in many cases, slowly paying users in small increments. Regardless, it’s still worth having PayPal for the sake of boosting credibility and conversions.

However, we do recommend that before opening up a PayPal account, it’s best to set up your sales funnel and Stripe account first. Ensure it’s all working the way it should. Then you can add PayPal to the mix.

If you’re a non-US resident and can’t get approved for Stripe or PayPal, there are a couple of alternatives that we recommend.

3. Payoneer

In some cases, you may not be able to set up Stripe. If you can set up a PayPal account, it’s perfectly possible to use this platform without Stripe and build your business that way. But it’s best to have both, particularly if you’re just getting started in the dropshipping business.

Keep in mind that, like with other dropshipping payment processors, you will have to deal with certain processes on Payoneer that can make setting up a little tricky.

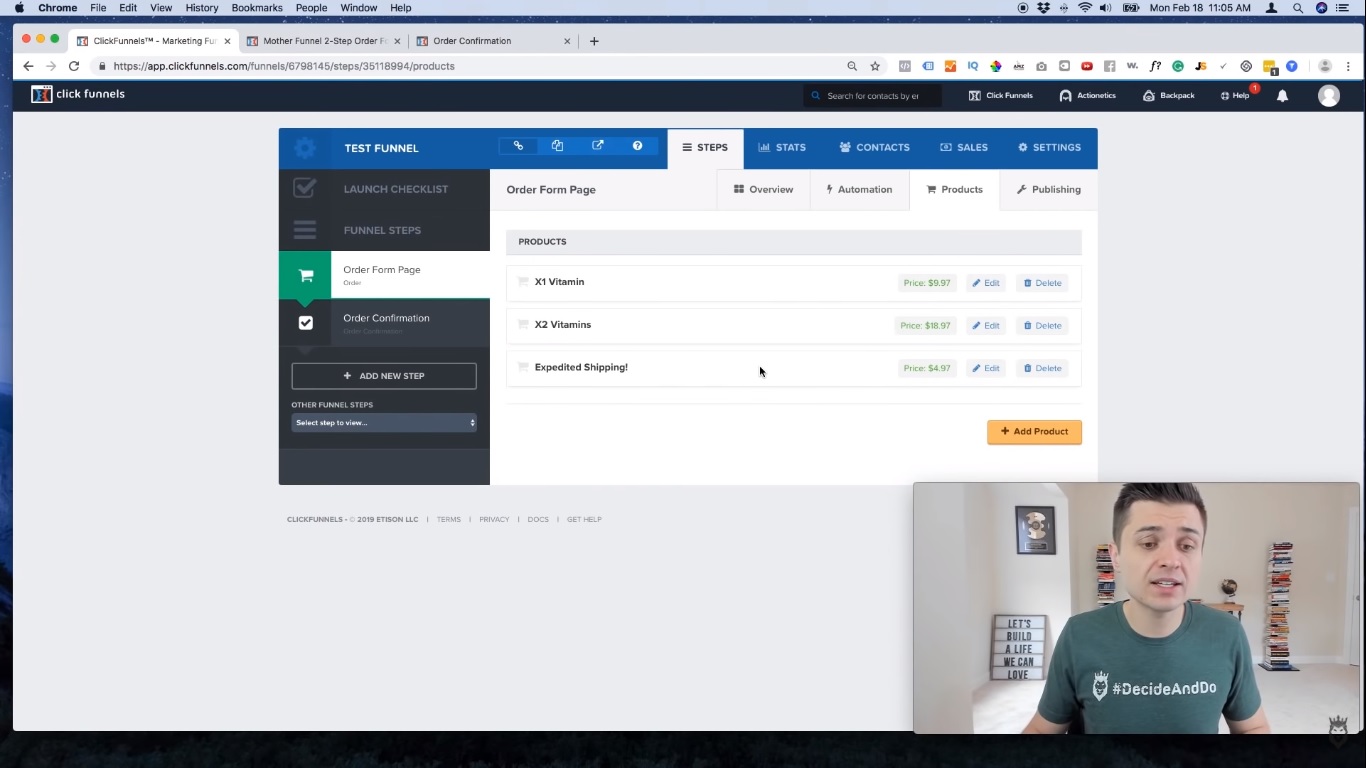

A few of the steps involved in setting up Payoneer and connecting it with Stripe will include:

- Signing up for a Payoneer account and linking it to your bank account

- Setting up a business LLC

- Using your LLC to create a Stripe account

We understand that the very thought of going through the process of setting up a business LLC may induce some eye-rolling. But there are certain steps that business owners need to take, and doing so will be worth it in the long run.

What happens when you create an LLC for both Payoneer and Stripe?

You can then connect that Stripe account with your Payoneer account. This step will enable you to receive payments in your local bank account. The entire process can take a few weeks to complete, but it will be more than worth the effort in the long run.

Once you have all of this set up and you’re ready to go, we can’t emphasize enough the importance of having backups in the event that something goes wrong and puts your business at risk. This leads us to our next recommendation.

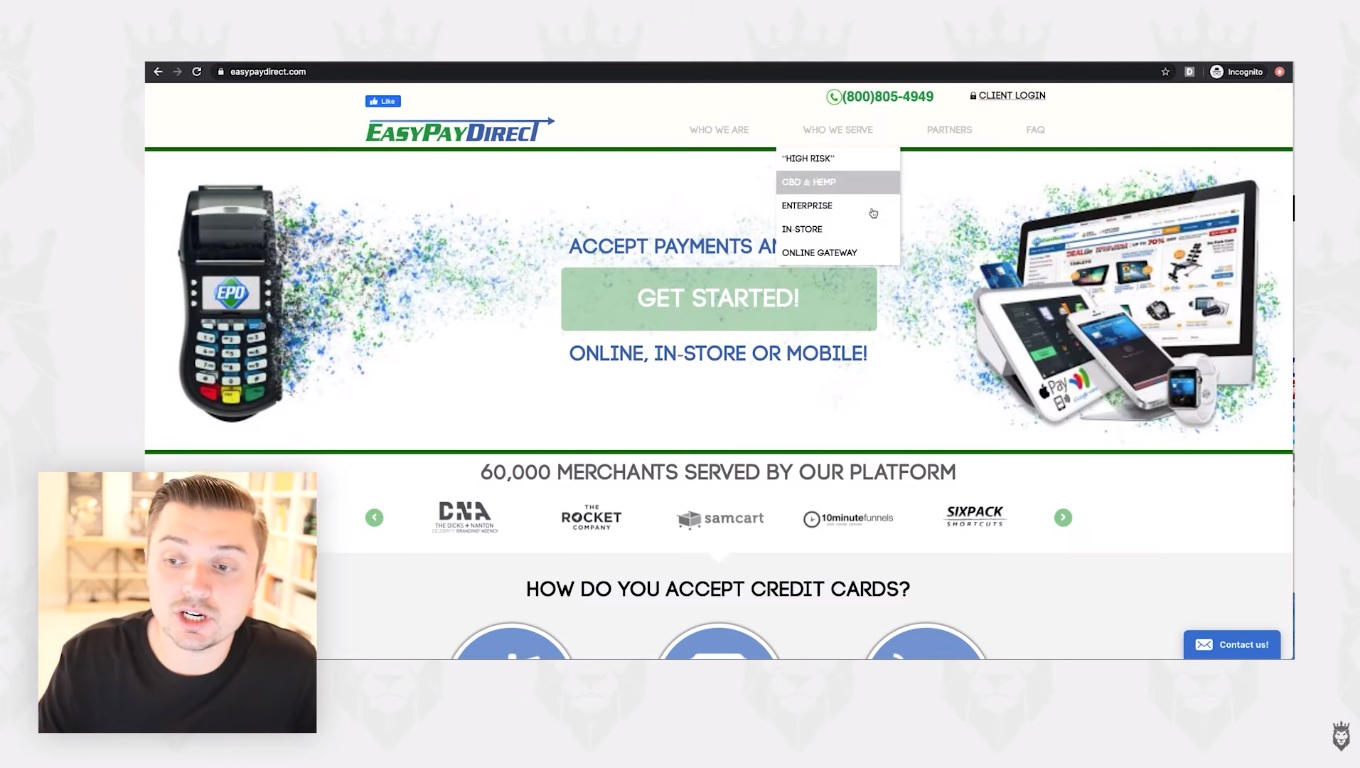

4. Easy Pay Direct

If you don’t have sufficient backups in place for your payment processing accounts on PayPal, Stripe, or Payoneer, this can leave your business vulnerable. If Stripe or another processor shuts you down for any reason and you have no backup solution, then you won’t receive payments. Subsequently, neither will your employees, leading you to essentially shut down your business.

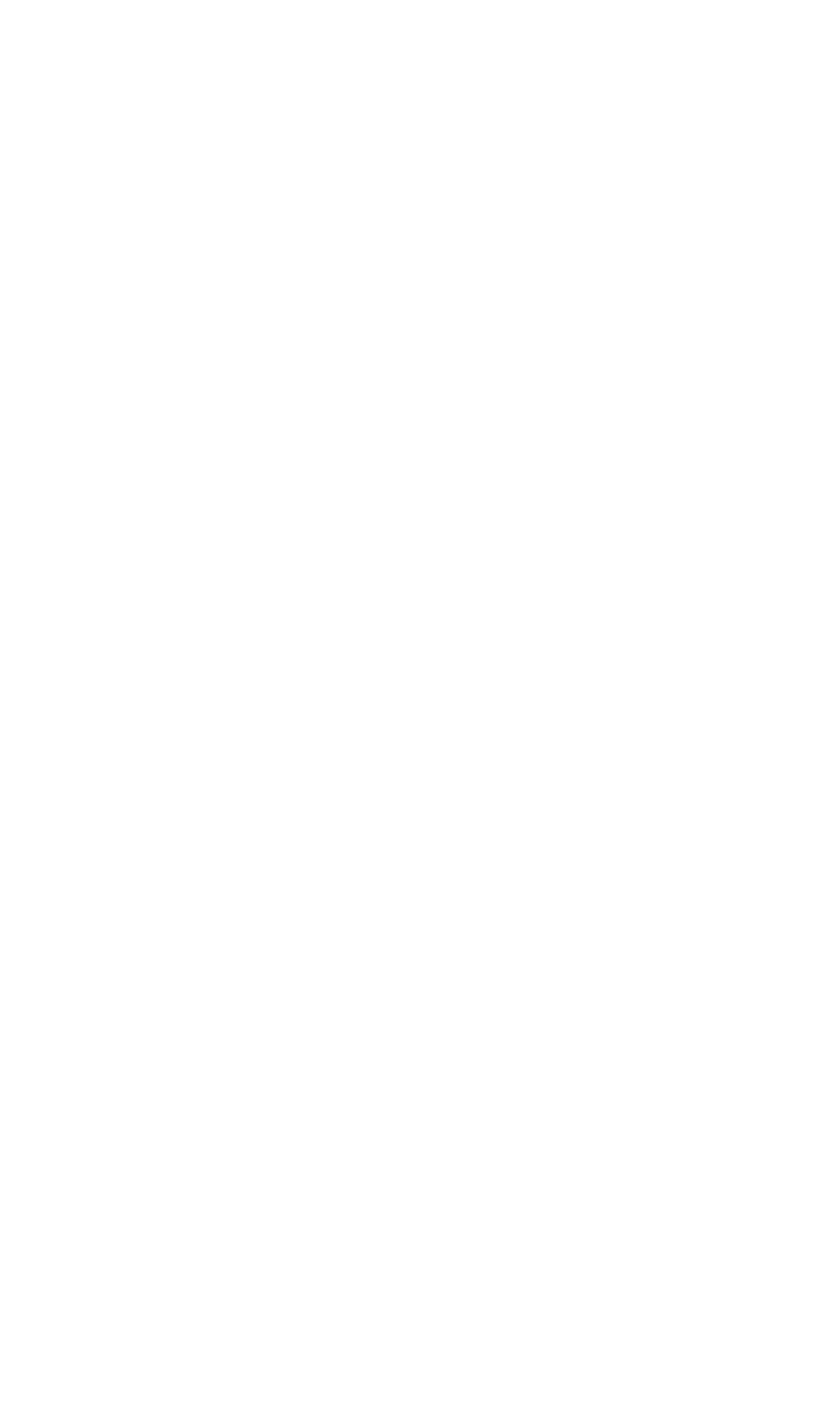

Easy Pay Direct is a great way to make sure you have backups in place. It’s basically a payment gateway, which is a kind of portal that can give you insights into multiple merchant accounts. Using Easy Pay Direct, you can be comfortable in knowing that you’ll always be in business even if something happens to your Stripe account or another account. Accidents can always happen in business, which is why it’s best to be prepared, and Easy Pay Direct is crucial to keep you protected.

You may need to build up some sales volume before you can get approved for Easy Pay Direct. Because of this, we recommend you set up your Stripe, PayPal, and Payoneer accounts first. Then scale your business before turning to Easy Pay Direct as a backup. You may also wind up paying fees upwards of a couple hundred dollars per month for Easy Pay Direct, but think of it as insurance that’s worth the investment.

Each of these dropshipping payment processors and gateways can help you only receive payments quickly and easily. They can also make sure that your business is consistently protected in the event of any issues with your accounts. Another great way to make sure your business is as consistently profitable as possible is to automate your order fulfillment process.

Consult With the Pros

Setting up dropshipping payment processors is just the start of your ecommerce journey. Learn more about how to build and grow your dropshipping business — reserve your seat at the free Ecommerce Empire Builders masterclass. We’ll teach you everything you need to know about starting a successful dropshipping business.